As digital transactions become the norm, The Future of Central Bank Digital Currencies (CBDCs) is a hot topic in global finance. Governments and financial institutions are exploring CBDCs as a way to modernize payments, enhance financial inclusion, and strengthen economic stability. But what trends will shape CBDCs in the coming years?

From decentralized finance (DeFi) integration to privacy concerns and cross-border adoption, the development of CBDCs will significantly impact both businesses and consumers. While central banks aim to offer secure, efficient, and government-backed digital currencies, challenges such as regulatory policies, cybersecurity risks, and monetary sovereignty remain key hurdles.

This article explores seven major trends that will define the future of CBDCs, examining their potential impact on the global financial system. Whether you’re an investor, policymaker, or just curious about digital currencies, these insights will help you understand where CBDCs are headed.

Let’s dive into the future of digital money! 💳✨

1. The Future of Central Bank Digital Currencies (CBDCs) in Global Finance 🌍💵

CBDCs are gaining traction worldwide, with central banks actively researching and piloting digital currencies. These state-backed digital assets could redefine how money is issued, distributed, and used, providing an alternative to cash while maintaining government control over monetary policy.

🔹 Why Are CBDCs Important?

- Financial Inclusion – Provides banking access to the unbanked population.

- Cost Efficiency – Reduces costs associated with printing and distributing physical money.

- Payment Modernization – Enables faster, real-time payments domestically and internationally.

- Monetary Policy Control – Gives central banks greater oversight over financial stability.

Currently, over 130 countries, including the U.S., China, and the EU, are exploring CBDCs, with some already launching pilot programs. China’s Digital Yuan (e-CNY) is among the most advanced, setting a model for other nations.

🔗 Learn more about global CBDC developments: IMF CBDC Tracker

2. The Rise of Retail and Wholesale CBDCs 🏦💳

CBDCs can be categorized into two main types: retail CBDCs (for public use) and wholesale CBDCs (for financial institutions). Each serves a distinct purpose in the economy.

🔹 Key Differences

- Retail CBDCs – Digital cash alternative used by individuals for daily transactions.

- Wholesale CBDCs – Used by banks for interbank settlements, improving liquidity and efficiency.

The European Central Bank (ECB) is developing a Digital Euro, focusing on retail transactions, while the Bank for International Settlements (BIS) is testing wholesale CBDCs for cross-border settlements.

🔗 Explore retail vs. wholesale CBDCs: BIS CBDC Reports

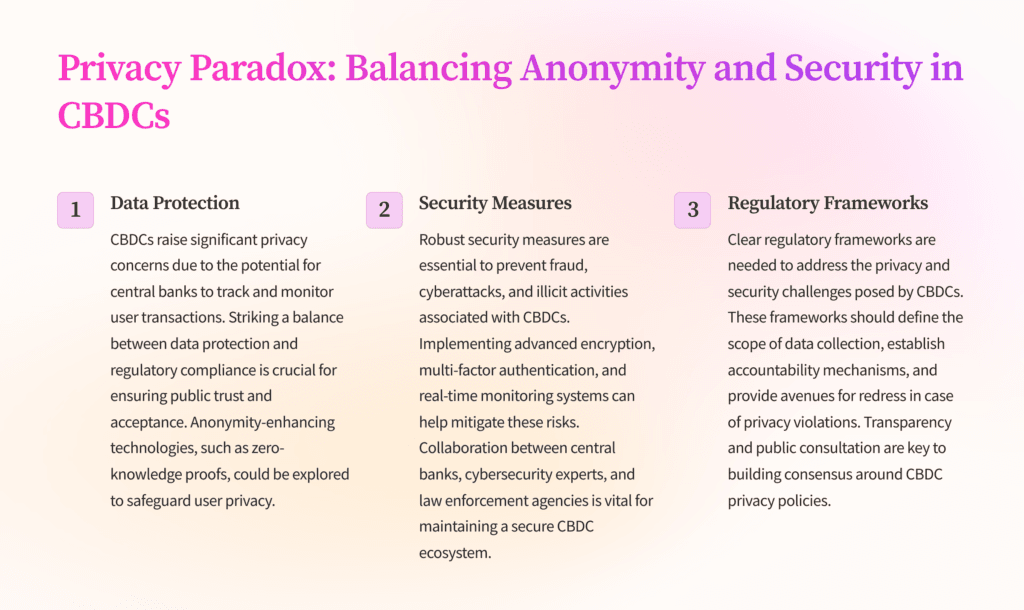

3. Privacy and Security Concerns 🔐📊

One of the biggest debates surrounding CBDCs is privacy. While CBDCs can offer enhanced security compared to cryptocurrencies, they also pose risks related to government surveillance and data tracking.

🔹 Key Privacy Considerations

- Transaction Monitoring – Central banks could track every digital transaction.

- Anonymity vs. Compliance – Balancing user privacy with anti-money laundering (AML) laws.

- Cybersecurity Risks – Protecting digital wallets from hacking and fraud.

Regulators must ensure that CBDCs maintain a balance between security and privacy, preventing unauthorized tracking while complying with financial regulations.

🔗 Read more on CBDC privacy challenges: World Economic Forum

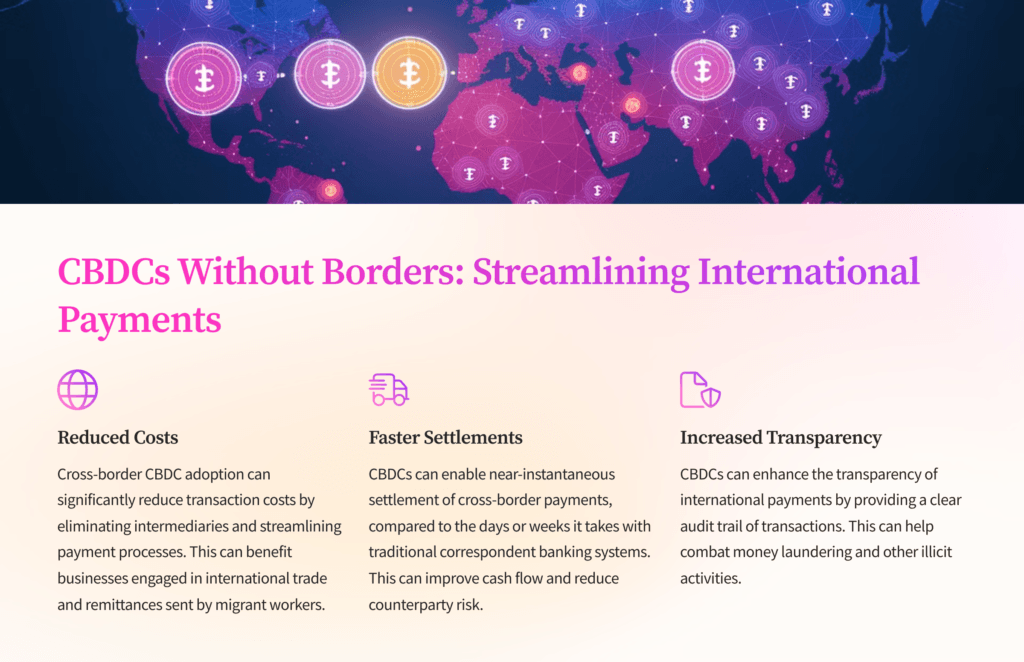

4. Cross-Border CBDC Adoption & International Payments 🌐💱

One of the most promising use cases for CBDCs is cross-border transactions, which are currently slow and expensive due to intermediaries. CBDCs could revolutionize international payments by enabling faster, cheaper, and more transparent transactions.

🔹 How CBDCs Improve Cross-Border Transactions

- Reduces transaction fees – Eliminates third-party costs in remittances.

- Increases transaction speed – Instant settlements instead of multi-day processing.

- Enhances transparency – Reduces fraud and money laundering risks.

Initiatives like Project mBridge by the BIS, Hong Kong, China, Thailand, and the UAE aim to develop an interoperable CBDC platform for global trade.

🔗 Explore cross-border CBDC projects: BIS mBridge

5. Integration with Decentralized Finance (DeFi) 🏗️🪙

While CBDCs are centralized by design, their interaction with Decentralized Finance (DeFi) could open new financial possibilities. By combining government-backed stability with blockchain-based smart contracts, CBDCs may bridge the gap between traditional finance and decentralized ecosystems.

🔹 Potential CBDC-DeFi Use Cases

- Smart Contract Payments – Automating transactions in lending and insurance.

- Tokenized Assets – Facilitating digital bond issuance with government-backed currency.

- Interoperability with Cryptocurrencies – Allowing seamless exchange between crypto and fiat-backed digital money.

Governments must navigate regulatory and security concerns before integrating CBDCs with DeFi platforms.

🔗 Learn more about CBDCs in DeFi: MIT Digital Currency Initiative

6. The Role of CBDCs in Reducing Cash Dependency 💳🚫

As economies become increasingly digital, cash usage is declining, and CBDCs could further accelerate this shift. Some countries, like Sweden (e-Krona) and China (e-CNY), are actively pushing digital currency adoption to reduce reliance on physical cash.

🔹 How CBDCs Could Replace Cash

- Eliminates counterfeit money – Digital currency is harder to counterfeit.

- More efficient tax collection – Reduces tax evasion and black-market transactions.

- Cost savings for governments – Reduces printing and handling costs.

However, concerns about financial accessibility arise, as not everyone has access to digital infrastructure. Policymakers must ensure CBDCs don’t marginalize cash-dependent populations.

🔗 Read more about CBDCs and cashless economies: European Central Bank

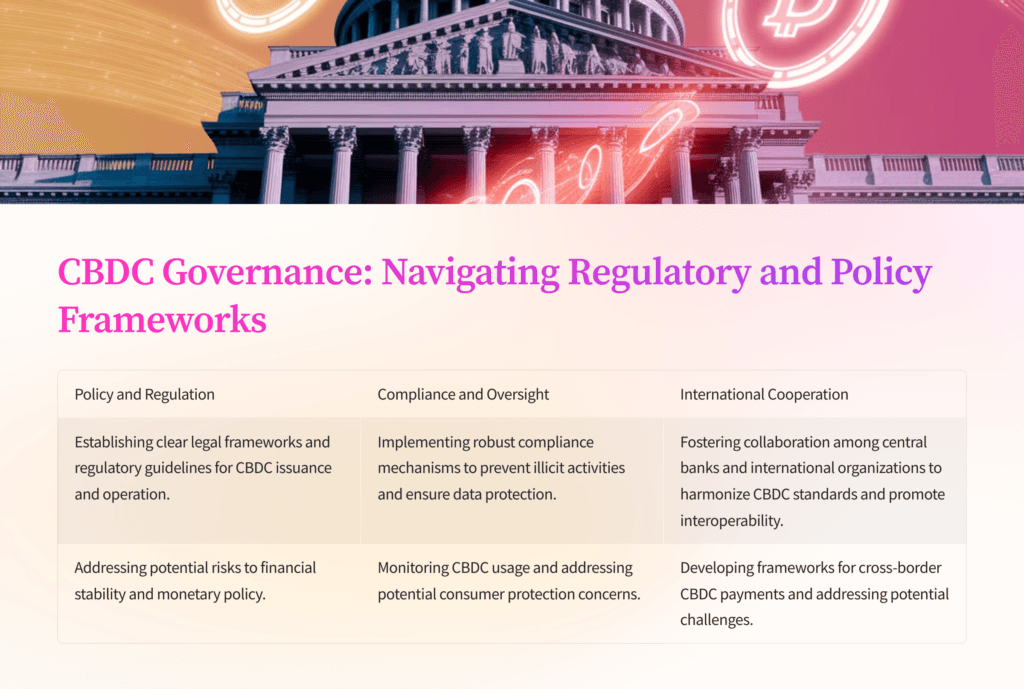

7. Regulatory Challenges & Government Policies 📜⚖️

CBDCs introduce a new set of regulatory challenges, requiring central banks and governments to establish clear policies on monetary control, financial stability, and consumer rights.

🔹 Key Regulatory Considerations

- Monetary Policy Impact – Preventing excessive control by central banks.

- Legal Frameworks – Defining how CBDCs interact with commercial banks.

- Consumer Protection – Ensuring digital wallets remain safe and insured.

Global regulatory bodies like the International Monetary Fund (IMF) and Financial Stability Board (FSB) are working on CBDC guidelines to maintain financial stability.

🔗 Explore CBDC regulations: IMF CBDC Policy

Final Thoughts: The Future of CBDCs 💡🔮

The future of Central Bank Digital Currencies (CBDCs) is filled with opportunities and challenges. As governments continue to test and refine digital currencies, we can expect greater financial inclusion, faster payments, and increased security. However, issues like privacy concerns, cybersecurity risks, and regulatory frameworks must be carefully managed.

Are CBDCs the future of money? Only time will tell. But one thing is certain—digital currencies are here to stay! 🚀

🔗 Stay updated on CBDC developments: World Bank CBDC Research

답글 남기기